Artificial Intelligence (AI), Brexit and supply chain uncertainty, collaboration, the Internet of Things (IoT), and cloud-based software systems. These are the five key food and drink supply chain trends expected to gain greater traction in 2019, according to systems provider FuturMaster, which works with the likes of Heineken, Danone Waters, Lactalis and PepsiCo.

But while each is likely to play an influential role in the drive to cut costs and improve efficiencies, FuturMaster believes there is one overriding trend that outweighs them all – increased data awareness.

“One trend sits above all the others, which is people becoming more data aware,” says Martin Sewell, sales manager for FuturMaster. “More data is becoming accessible and senior management are beginning to see the value of it much more than they have done.”

Supply chain software firms are having to adapt to this awakening, Sewell suggests, and provide food and beverage companies with the capability to absorb the extra data so they can analyse it efficiently and use it to make forecasts.

“People are beginning to realise that if they integrate data into their decision-making, they make far more effective decisions and solve problems that the human mind quite simply isn’t capable of doing,” he explains. “We are seeing much more interest at a senior level in integrating full costs into their supply chain and planning.”

This allows companies to adopt much greater flexibility in their sourcing and suppliers to identify how to reduce costs – something that Brexit has brought into sharp focus, Sewell adds.

Increased complexity

Before even considering Brexit, it’s no surprise that data has become so important, given how complex the food and drink supply chain has become for manufacturers. Changing consumer demands combined with increased competition between retailers and the rapid growth of online sales of groceries mean that seamless deliveries across several sales channels – the omnichannel – is making life far more difficult.

Increasingly, the move is towards cloud-based supply chain software that can collect vast quantities of data, which then uses artificial intelligence (AI) to analyse it and provide greater demand planning accuracy. At the same time, there is a trend towards the use of ‘software as a service’ (SaaS), rather than purchased software packages, which soon become outdated.

With the enhanced capabilities that new system technologies provide, more accurate forecasting is possible, helping to minimise ‘stock-outs’ on supermarket shelves or unnecessary waste as a result of unexpected weather conditions or poor predictions about promotions.

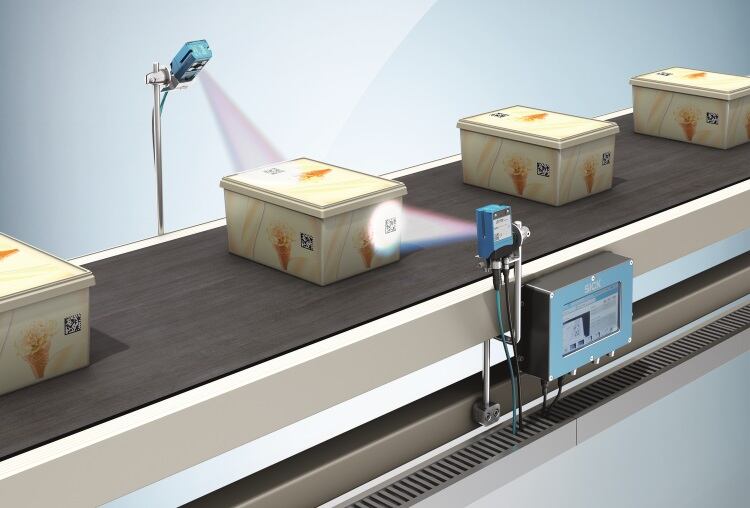

Linked to GPS and smart sensor technologies, the latest systems provide better accuracy of information and traceability along supply chains, giving assurance about where products are at any given time and what condition they are in. Thanks to the emergence of Industry 4.0 and the IoT, such interconnectivity of sensor data enables far better tracking and visibility – from the farm, all the way to supermarket shelves. Accurate information is key.

Northern Ireland-based food accompaniments manufacturer Avondale Foods, for example, has invested in a shipping verification system from Zetes as part of a systems upgrade to meet a 100% shipping accuracy requirement, while raising efficiency and real-time supply chain visibility, to meet Marks & Spencer’s new requirements for improved inbound logistics visibility. For Avondale, delivery lead times are very short, with orders typically being received at 6am for despatch the same day. Speed and the absolute elimination of shipping errors are paramount.

Another global provider of supply chain systems in the vanguard of these changes is JDA, which provides software to companies such as PepsiCo, Kraft-Heinz, AB InBev, Coca-Cola Femsa and Heineken. JDA’s Luminate software, running on the Microsoft Azure cloud-based platform, embraces AI and machine learning to optimise data analysis. It has just announced a partnership with Panasonic to develop the next generation of integrated digital supply chain technologies.

“Manufacturers are living in an omnichannel world, so they need to get closer to their customers,” says Simon Bowes, global vice president of solutions advisory at JDA. “They are also dealing with SKU [stock-keeping unit] proliferation, which is making it more and more difficult.”

Handling the omnichannel

Omnichannel increases the pressure to hold more inventory, but that isn’t the solution, Bowes adds. “Really, the answer is to reduce your inventories and be more flexible. Ultimately, a lot of that comes down to being able to predict your demand better and having confidence in it.”

That’s where probabilistic forecasting comes in, says Bowes. The use of AI to crunch huge quantities of supply chain data and combine this with information gleaned from social media, news, events and weather is starting to make this a reality, he adds. “JDA is now using AI to allow our customers to look at multiple sources of data, instead of just historic sales, and make predictions into the future.”

Working with Amazon Web Services, Infor also supplies food firms, such as Kellogg, ABP and Pork Farms, with cloud-based software. This includes its Coleman AI analytics and data science modules. Andrew Kinder, Infor’s vice president for manufacturing industry marketing, concurs with others that, today, traceability is a key consideration. Far more granularity of information is required than solely to meet regulatory compliance, he adds.

“The older way of maintaining that traceability was part system, part manual. So, some of it was done by your enterprise resource planning systems, some of it by manual record-keeping, and what is changing is that this is where you get into conversations about IoT,” says Kinder.

Infor recently worked with New Zealand dairy company Synlait to provide farm-to-consumer traceability and assurance. It follows the 2008 scandal of milk and infant formula on sale in China being contaminated with melamine.

Despite much hype around the use of blockchain, Kinder believes this technology will find increasing use in improving the traceability and, ultimately, the safety of food along the supply chain. “I’ve talked to companies that are having discussions in this area,” he explains.

A cloud-based future

Kinder also predicts a future in which the transport and logistics of online grocery supply chains delivery to the end-consumer will all be cloud-based and centrally controlled by an independent operator, such as Amazon.

“The supply chain will move to this network-centric view, which has to be in the cloud,” he says. “It will probably be independent of a particular owner, because that way you can make maximum use of unused transport capacity.”

“I haven’t got a crystal ball, but you could imagine Amazon being the closest to delivering that if they chose to go in that direction. Though for someone, somewhere, that will just become a platform for transportation.”