Consumer confidence in glass packaging

Consumers increasingly turned to glass packaging for its sustainability benefits and ability to keep products fresher for longer, according to a new report commissioned by the European Container Glass Federation, Feve.

In a survey of more than 4,000 consumers across 12 European countries, eight in 10 said glass was a packaging material fit for the future, while more than a third said they chose more glass packaging specifically because it better preserved health and kept products safer for longer.

Glass was the only packaging material that consumers said they used more of in the last three years – by 8% – while bag-in-box, metal, and plastic all saw drops of between 24%-41%.

Commenting on the results, Adeline Farrelly, secretary general of Feve, said: “These findings prove that consumers increasingly recognise glass as a healthy, widely recycled everyday packaging material – one that is already proven to deliver on commitments to a healthier world.

“We’re happy to see consumers recognize these qualities and validate that glass is the packaging material that will see us into the future. Now it’s over to our favourite brands to pick up that challenge.”

Packaging innovation in the frozen aisle

Frozen smoothie kit maker Pack’d have furthered its commitment to sustainable packaging with the launch of recyclable paper bags.

The move to paper film came in response to consumer feedback that was overwhelmingly in favour of the plastic free packaging but concerned about the practicality of storing bulky cartons.

Alex Stewart, chief executive and co-founder of PACK'D, said: “We’re proud that this will be one of the first frozen packs in curbside recyclable paper anywhere in the world. For us curbside recyclability is everything, otherwise we’re just passing the buck to our customers and giving them an extra task.

“It’s our job to make sustainability easy for our customers, not more difficult and that means we need solutions that work for them and not just for us. We’re on course to be completely plastic free in 2023 and so far we’ve managed to remove 13.6 tonnes of plastic per year from our supply chain.”

UK vineyard trials flat wine bottles

Cotswold Hills has become the UK’s first vineyard to trial the use of Packamama’s flat wine bottles.

A small run of the 2021 English white wine will be available in the new sustainable eco-flat bottles as part of an ongoing, student-led, project undertaken at the Royal Agricultural University (RAU).

Hugo Sain-Ley-Berry-Gray, the RAU’s student lead on the project, said: “As students of food and agriculture, we are conscious of the carbon footprint associated with the industry. For the wine sector, glass bottles account for a high percentage of these emissions.

“Eco-flat wine bottles offer Cotswold Hills a product that aligns with our sustainability objectives. Reducing the weight and changing the material of our bottles is a step in the right direction to solve an existing problem. As new entrants into the industry, this was an opportunity we were keen to explore.”

Packamama’s eco-flat bottles are made with 100% recycled PET. It claimed the format provided carbon emissions saving of around 50% compared to typical, round, glass bottles.

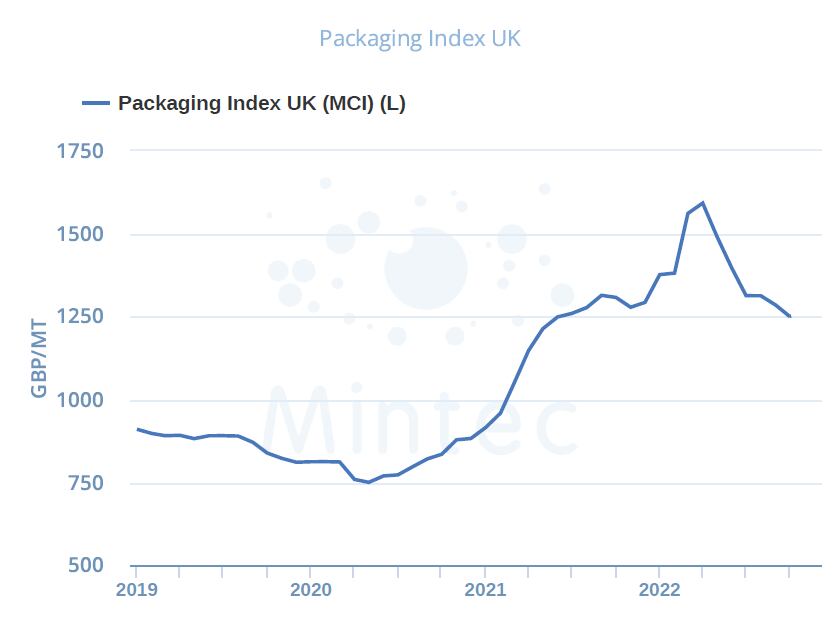

Mintec Packaging Index

The Mintec Category Index for UK packaging fell to GBP 1,250/MT in October 2022, down 3% month-on-month (m-o-m) and the lowest since June 2021.

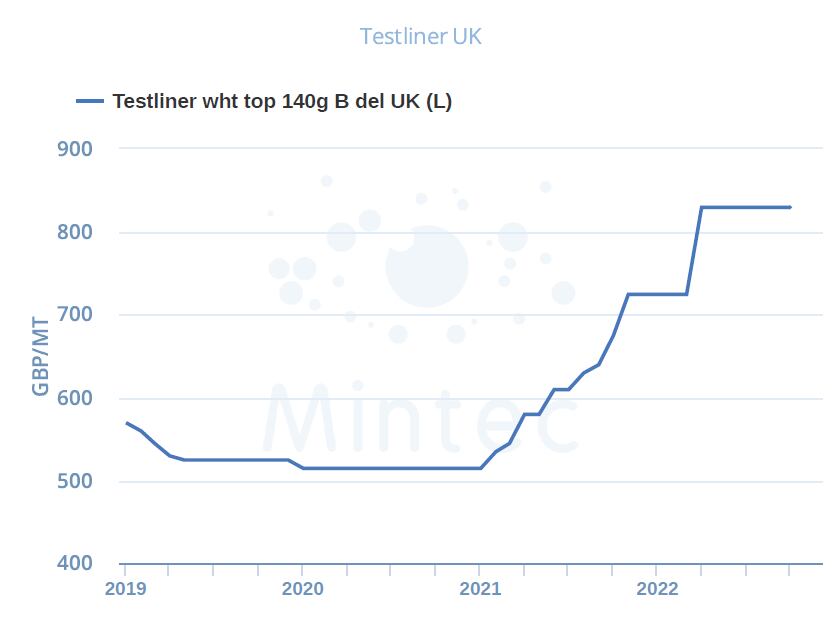

Prices for UK testliner have been flat since April 2022, at a record high of GBP 830/MT. The main reason for stable prices at high levels is strong demand for testliner. However, there is a downward price trend in the European paper industry due to the lower cost of energy, which has started to fall since September, and the low prices of recovered paper.

Many players in the European market therefore expect testliner prices to fall without cost support. The budgeting process for 2023 is difficult to determine, because consumers do not want to see testliner prices at historic highs. As a result, they are putting significant pressure on manufacturers, because consumers know that lower costs should be reflected in finished product prices.

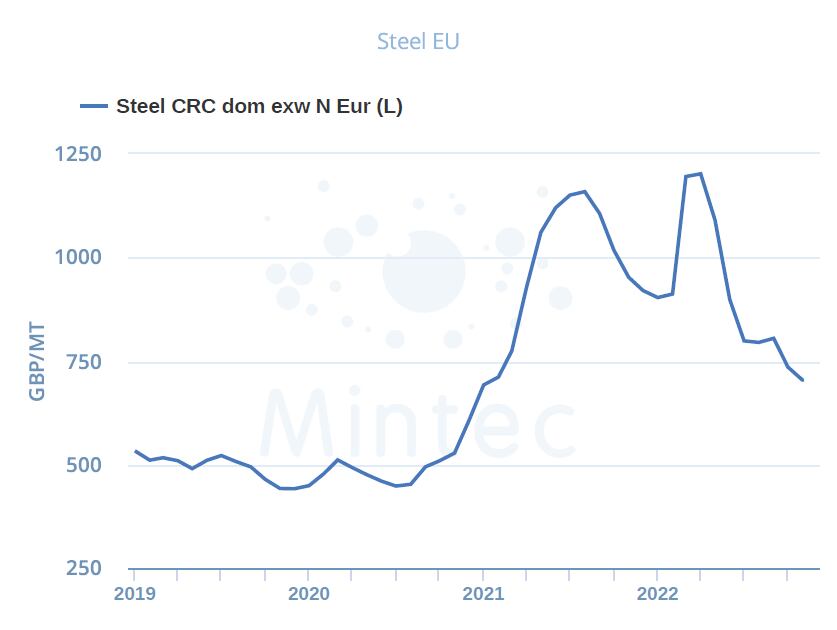

The Northern Europe HRC price dropped by 9% m-o-m in October, to GBP 736/MT, as EU steel-consuming sectors have been in decline. The EU Construction Confidence Indicator from Eurostat turned negative for the first time in 19 months in October, and steel consumption in the automotive sector is set to fall by 3.6% in Q4, according to the Europher report. In addition, steel production costs began to drop globally in October due to a 6% m-o-m decline in iron ore prices.

Furthermore, steel scrap prices and energy costs in Europe fell in September and October. The market can now be characterised as a buyer's market, with factors affecting production costs having a strong influence on steel prices.

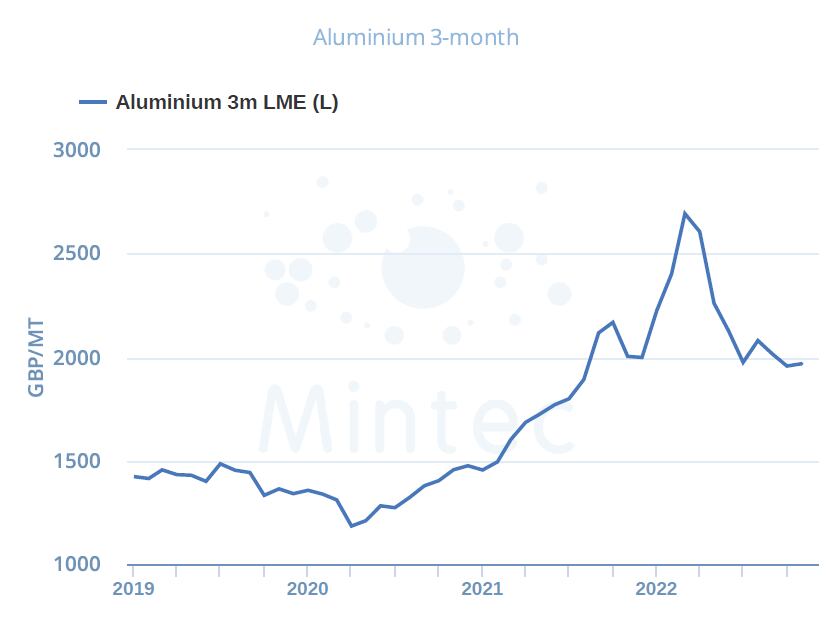

The LME aluminium (3-month) October price was flat m-o-m in dollar terms, with a monthly average price of USD 2,249/MT (GBP 1,958/MT). Rising electricity prices in the EU have led to the reduction of some aluminium capacity in the region. Consequently, almost one million tonnes of primary facilities have now shut down in Europe.

Aluminium production is an energy-intensive process and, even though electricity prices in Europe have started to decline since September, production costs remain high relative to current market prices for aluminium products. Traders have seen market prices stabilise and have started to build up stocks on the LME.

This is the second consecutive month that stocks have risen, having almost doubled compared to August. This significant growth does not constitute an increase in stocks, however; it is merely a correction after the collapse of the indicator in the second half of 2022. Thus, the level in October is about three times lower than the monthly average for 2021.

Content provided by Mintec