A keen lifestyle athlete, Tim Davies has long known the importance of ‘refuelling’ before and after exercise.

Spotting a gap in the market for a convenient two-in-one solution that offered carbs before exercise and protein after, he started work on his company DuelFuel in 2020.

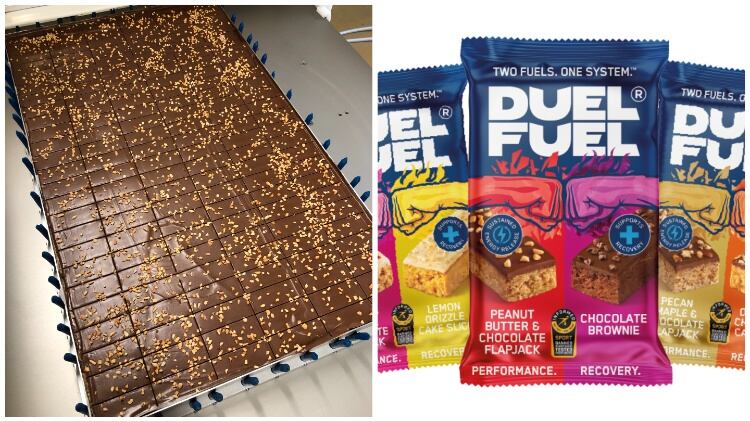

“We came up with a flapjack and a cake duo – a low sat, low sugar flapjack and high protein cake slice in one pack,” he told Food Manufacture.

“I knew the unit cost of manufacturing DuelFuel was going to be relatively high, not least because we have two food products in one, the packaging format, and the fact it’s handmade in a bakery. So I did a lot of research into VAT and cake and flapjacks. I read HMRC’s internal guidance, I studied past tribunal cases and I sought advice from two VAT experts.”

Whilst Davies was resolved that the product would be zero-rated and therefore financially viable, he wanted to get absolute certainty so he could give future investors peace of mind.

Subsequently Davies wrote to HMRC, submitting a non-statutory clearance application in October 2021. The response was not what he was expecting.

Let them eat cake

VAT is a broad-based tax on consumption and the 20% standard rate applies to most goods and services. The basis of the VAT relief is to allow zero-rating for staple food and drink that is meant for human consumption.

The modern-day VAT law and regulations on cake, chocolate biscuits and confectionery can be dated back to the 1960s.

In 1962, the Conservative Government introduced a new purchase tax on confectionery, soft drinks and ice cream. This new law included chocolate coated biscuits within the definition of confectionery.

Commenting on the reasoning behind this, then financial secretary to the Treasury, Anthony Barber, said: “The reason we decided to do this was simple. It was because chocolate biscuits are, as many hon. Members know, put up for sale in a wide variety of forms, and it is quite impractical to draw a dividing line between them.”

When questioned if cake was included within the tax, he responded: “I can only assure hon. Friend that other biscuits, cakes and pastries are outside the scope of the tax.”

Davies gave further historical context: “From that time onwards, from the Purchase Act 1963 right the way through until the Value Added Tax Act 1994, cake has not been subject to VAT and not part of confectionery as a group of products.”

The 1994 VAT Act outlined a few exceptions to zero-rated, which includes but is not limited to, confectionery, ice cream and frozen yoghurt.

Within this specific Act, Excepted Item 2 of Schedule 8 stipulates that confectionery does not include ‘cake or biscuits other than biscuits wholly or partly covered with chocolate or some product similar in taste and appearance’.

Certain amendments were later added to the Act in 1998, to ensure cereal bars fell within the Act’s definition of ’confectionery’.

At the inception of VAT, flapjacks were widely accepted as cakes and remain so today, with the exception of a few clauses.

Cereal bars on the other hand are standard rated. These were not readily available at the time of VAT’s birth but have since become much more popular, at the same time as the gap between flapjacks and cereal bars have narrowed.

In an attempt to make a clear distinction, HMRC determines flapjacks can have minor variations such as dried fruit and chocolate chips or a yoghurt topping and be zero-rated as long as they are made solely from oats and not include any other cereals. Whereas any product containing cereals other than oats is deemed to fall outside this distinction and thus are standard rated as confectionery.

“We understood this distinction and adhered to it in full. The only cereal in our flapjacks is oats,” Davies commented.

Is it a cake?

Davies was certain the response from HMRC on DuelFuel would be a simple: carry on as you were.

But when HMRC gave its initial ruling in January 2022, it deemed DuelFuel not to be cake but rather confectionery and, therefore, subject to 20% VAT.

“It was always designed to be a cake,” Davies said on his product. “We specifically chose a bakery which makes traybake cakes.

“There is no accepted definition of cake. The closest one I can find is dry ingredients meet wet ingredients and are mixed together with a rising agent, and put in the oven and baked. That’s probably the best description I can give for our DuelFuel cakes.

“I can’t see how it can be anything other than a cake.”

The assessment

The term ‘cakes’ is not defined in legislation and therefore takes its ‘ordinary meaning’.

To determine whether a product is a cake, HMRC considers it from the perspective of an informed ‘ordinary person’, a range of factors which include its ingredients, texture and marketing – this is known as a multifactorial assessment.

One of the key areas DuelFuel’s cakes were assessed on was whether the products became hard or soft when exposed to air. In its letter to Davies with its initial ruling enclosed, HMRC said the products did ‘not dry out like a cake would’.

DuelFuel appealed HMRC’s decision to them directly, with Davies writing to HMRC, stating he “knew this to be incorrect”. He explained to Food Manufacture that subsequent tests were carried out by independent lab MicroSearch to serve as proof. According to Davies, the tests found that the product samples did indeed dry out.

If you’re familiar with the Jaffa Cake case, you’ll know that it was this which helped tipped the scales in favour of them being classed as a cake and not a chocolate covered biscuit. In summary: cakes dry out, biscuits get soggy.

With HMRC upholding their original decision to standard rate DuelFuel as confectionery, Davies filed an appeal against this decision with the First Tier Tax Tribunal, and whilst the Tribunal’s subsequent judgement referenced the tests DuelFuel had conducted by MicroSearch, stating that the samples of the products ‘tended to dry out when left exposed to air’, Davies said the Tribunal gave “no weight,” to this moisture loss in its final judgement.

There were other areas which HMRC had issue with too. Specifically, it was flagged that the use of protein powder instead of conventional flour meant the product could not constitute as cake, stating that a traditional cake must contain sugar, flour, eggs and milk.

Since, Davies has been campaigning on LinkedIn, inviting people to Google ‘cakes made with protein’ and ‘cakes with collagen’ and ‘cakes with no butter, flour, sugar and eggs’ to prove his point that cakes could very well contain alternative ingredients.

“We’re all getting somewhere between 35m to 235m hits,” he claimed.

Consumers want healthier cakes

Commenting further on HMRC’s decision, he added: “It’s not reflective of the way consumers are asking cake manufacturers to reiterate their products in light of concerns over saturated fats and sugar.

“Cakes have evolved!”

In another case a few years ago, a judge ruled that a ‘health brownie’, known as Pulsin, containing dates and brown rice bran and which was not baked, was indeed a cake.

The judge on the Pulsin case said that the ingredients used, manufacturing process, taste and texture were consistent with cake; and acknowledged that the rise in obesity has led the public to seek out different types of cakes to those popular in times gone by.

“If we’re not a cake, we must therefore be confectionery,” Davies said in apparent disagreement to his own product’s ruling.

He argued that DuelFuel’s ingredients which include vitamins and minerals and lower saturated fat and sugar content, all of which “make it healthier than a conventional cake”, have penalised the business.

This is also despite the HMRC Internal Manual VFood 1940 for Enriched Foodstuffs stating that the addition of a supplement to an otherwise normal food product (such as vitamin-enriched bread, fruit juice with added-fibre) does not change the usual liability of the product.

“All these things that make the product healthy mean we’re confectionery. It’s bonkers.”

But it wasn’t just the ingredients, HMRC also ruled that DuelFuel’s packaging ‘was not what an ordinary person would expect of a cake’, nor was the marketing or use of the product (i.e. to be eaten before and after ‘vigorous’ exercise) typical of a cake.

What’s notable here is that HMRC’s original ruling sent to Davies in March 2022, allegedly stated that the flapjack portion of the product looked and tasted like flapjacks, possessed the same texture and an ‘ordinary person’ would describe them as flapjacks.

Davies showed Food Manufacture a screenshot of HMRC’s original ruling, which read as so: ‘Though the ordinary person on the street might think the tray bake of flapjacks at e.g. the school cake sale is a cake, that doesn’t necessarily mean they would think the same about these products being sold in a gym or next to the protein bars in the supermarket’.

“So a flapjack changes identity depending on where it’s bought?” he questioned, adding sardonically: “So if I buy a banana in the supermarket that’s a banana, but if I buy a banana in the gym, what…that’s whey protein?

“A flapjack is a flapjack whether you buy it at a cake sale, a supermarket, or a gym.”

What’s happened to DuelFuel since HMRC’s verdict?

In the case of DuelFuel, the Tribunal has found that the products do not fall within the ordinary meaning of ‘cakes’ and instead fall within the legal definition of confectionery, which includes ‘…any item of sweetened prepared food which is normally eaten with the fingers’.

Commenting on the verdict, a HMRC spokesperson told Food Manufacture: “We welcome the decision which confirms that these products are standard-rated confectionery for VAT purposes.”

But Davies hasn’t given up yet.

The DuelFuel founder continues to be active on LinkedIn, highlighting what he considers to be an incorrect decision. But given the cost and time and pressure of it all, his business has since had to stop production.

“We had invested a considerable amount into DuelFuel during our first product run; and because the VAT status was unclear, retailers couldn’t or wouldn’t buy it. As a start-up founder you wear many hats – and the HMRC issue made the workload unmanageable.”

Davies explained he would have had to pass that VAT cost onto consumers and market research told him that the price point would have been considered too high.

“There was no choice whatsoever. We stopped trading in summer 2022.”

He continued: “We have a big decision to take – do we appeal the tribunal’s decision. I believe we have solid grounds, but these things come at a cost – not just a financial cost but a resource cost.

“The phone rings regularly from other food manufacturers encouraging me to appeal. I think there’s concern that this sets the groundwork for a very dangerous precedent for the wider functional food industry.

“There is a growing concern over the opaqueness of the regulations that govern the food sector.”

When asked what was dangerous about HMRC’s ruling, Davies replied: “These decisions have a real impact on real people’s lives. It stifles entrepreneurialism. This has buckled DuelFuel – if we stayed on plan, we could have been a £2-3m turnover a year company. The tax revenues that DuelFuel would have generated in terms of national insurance, PAYE, even corporation tax would have far outweighed the VAT they’re quibbling over.

“We should not be strangling a business at birth.”

If a cake containing protein is determined not be a cake, and a flapjack not a flapjack because it contains vitamins and is eaten on the go, then what other food products will now be subject to identity and VAT status challenges too? As Davies questioned: "Who is next?" And will such rulings go directly against lobbying to reduce obesity rates in the UK, as a result of potentially restricting future health-geared food innovation?

Whilst Davies hasn’t decided whether to appeal just yet, he acknowledges that going to an Upper Tribunal would be the ideal next step.

If he won, it would set a precedent in the future for all those facing the same challenge.