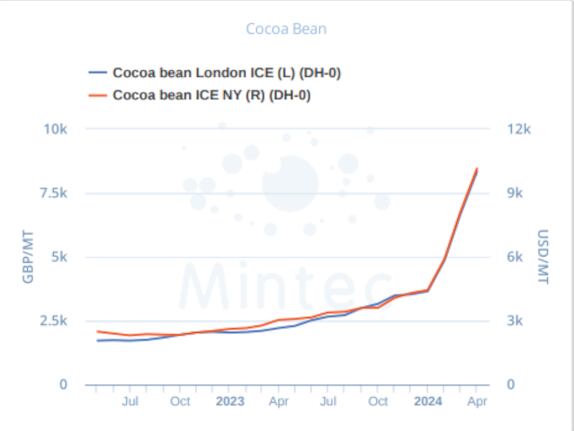

Cocoa Bean

From an already high base, the front month London futures contract (May) made another staggering rally of 51 % month-on-month (m-o-m) to £8,207/MT, setting new record highs on a nearly daily basis.

The steep rally prompted some speculator short covering after new shorts entered the market in February. Much of the rally was driven by increased media coverage of the industry and the structural deficit both this year and potentially in the future, as the fundamental factors driving lower production are unlikely to change much in years.

Prices in New York also made enormous gains, with the front month May contract closing 54% higher m-o-m to $9,843 (£7,893)/MT, and the price briefly topping $10,000 (£8,019)/MT on a few sessions at the end of the month before closing slightly lower each day.

With commercial (producer) short covering driving much of the rally, New York was also buoyed by dwindling certified stocks as well as more pessimistic forecasts for the end of year supply deficit. Prices did fall sharply on the last two trading days of the month as new managed money (speculator) shorts have entered, and specs in general continue to trim their net long position.

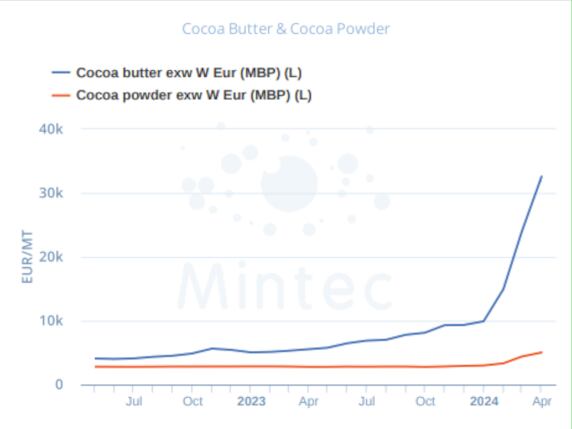

Butter and Cocoa Powder

Inventory levels of semi-finished products (butter, liquor, powder) are "very low". Major processors are having to lay out far more cash to secure the beans, given the recent price increases, which has made operations difficult and eaten into commercial margins. As a result, the just-in-time nature of the supply chain has “dried up” in the words of one trader.

The Mintec Benchmark Prices (MBP) for spot Cocoa Butter EXW Western Europe rose by a staggering 87% m-o-m, from just over €17,000/MT at the end of February to €31,979/MT by 27th March. The MBP for spot Cocoa Powder EXW Western Europe increased by 32% m-o-m in March to €4,388/MT.

Both a surging terminal price, as well as substantially higher ratios, drove large increases across the entire product complex. Sources told Mintec that processors are running on “very limited supplies”, as they are unable to source the volumes of beans required from west Africa, and the high capital outlay to do so, combined with high storage costs, has either dissuaded processors from doing so (despite high order volumes) or simply incentivised them not to.

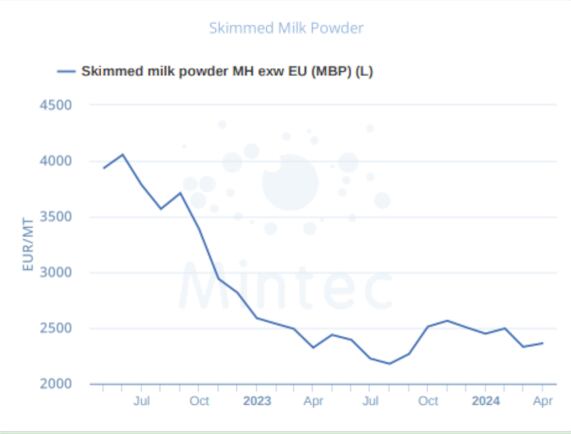

Skimmed Milk Powder

The MBP for skimmed milk powder (SMP) EXW Europe was assessed at €2,300/MT on 28th March, down €150/MT (-6.1%) on the month. The EU SMP market was bearish in Marc, as weak domestic and international buying interest outweighed bullish fundamentals. During the last week of March, a large by a major international buyer tender for SMP provided a temporary market boost, although this was short-lived.

Sugar

A lack of compelling sugar-specific fundamentals during the month led to the ICE#11 sugar futures testing both the USc 21.00/lb support and the USc 22.30/lb resistance thresholds in March 2024.

The May 24 ICE #11 settled 0.8% lower than a month ago at USc 22.39/lb ($493.61/MT) on 26th March 2024). The July 2024 contract settled at USc 22.01/lb ($485.24/MT), resulting in the nearby spread remaining virtually unchanged compared to last month at a premium of 29 points.

The ICE #5 (London) white sugar contract increased by 4.8% m-o-m to $653.40 (£523.96)/MT, resulting in a significant 33.0% m-o-m increase in the “white premium” (refiners’ margin) to $155.96 (£125.06)/MT (May/May basis).