Kellogg’s boss blames recessionary climate for Nature’s Pleasure retreat

Speaking at the launch of the firm’s new Coco Pops Choc ‘N’ Roll cereal in London, Peterson told FoodManufacture.co.uk that the premium cereal, which had a launch budget of £3m in March 2009, had been blighted by economic problems.

“We were obviously at the mercy of a poor economic climate, and are mindful of the risks going forward in terms of NPD. We do our best so that when we put something out into the marketplace it’s going to be successful.But you know what? Sometimes it just doesn’t work, despite all our best efforts.

“If a product isn’t meeting our hurdles, we won’t be shy about taking it off the shelves. We have to be a responsible supplier. If we’re not helping grow a category, then we’re not doing ourselves or the retailers any favours."

Nature’s Pleasure was marketed as a healthy-eating muesli that was high in fibre and low in salt – containing whole grains, nuts, fruit, honey and cane sugar “gently baked” – and was expected to post annual sales of £6m.

However, disappointing performance saw the muesli scrapped this March. A Kellogg’s spokesman added: “Production costs were higher than normal given the ingredients, but the economic climate played a factor. People had less money and were less willing to spend, so the trial of a higher-priced product was restricted.”

Marginal appeal?

Jonathan Gabay from consultancy Brand Forensics said he thought Kellogg’s had perhaps come up with too marginal an offering in Nature’s Pleasure.

“We all profess to want healthy products but making a success of them is another matter. I suspect what happened with this cereal is that it was too niche.

“There are two ways of building such a brand: a viral branding effect that starts from a low base or sustained marketing. Even though a brand leader such as Kellogg’s has the financial clout to develop a product they can only go so far if things don’t really work out. That said, businesses have to take such risks to grow.”

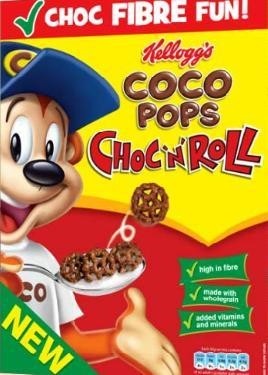

Kellogg’s axed the Coco Pops Straws and Creations varieties in February, but last week’s launch saw the firm hit back, as Peterson unveiled Choc ‘N’ Roll, a high fibre, wholegrain cereal with added vitamins and minerals. It aims to give children a tasty product with less sugar (14/g per 40g serving with 125ml of semi-skimmed milk) than rivals Coco Shreddies, Nesquik and Sugar Puffs.

‘Adult treats’ the future

Nonetheless, Kellogg's said that cereal makers were seeing strongest growth in the high-margin “adult enjoyment sector”, which included cereals such as Krave, which was targeted at 16 to 25 year-olds in a £4m launch in February. This represents a new target demographic for Kellogg’s, and one that traditionally eats little cereal.

Peterson said that an adult cereal such as Krave – which won bad press for its relatively high sugar and fat content – was marketed primarily on the basis of its great taste rather than health benefits.

He said: “Krave is marketed essentially for folks who are just heading off to university, so it’s people who are old enough to choose what they are doing and what they are eating. Cereal generally scores well on fat, low salt, all those kind of things. But our point of differentiation [for Krave] is based around its unique taste.”

Krave's success appears to reflect a broader point that, in continually reformulating products to reduce sugar and salt, cereal firms risk alienating shoppers: if the latter dislike the taste of a cereal they may move on to unhealthy alternatives.

IRI figures also suggest that sweeter cereals are performing strongly, with volume sales of Crunchy Nut Cornflakes up 12.6% and value sales up 21.5% to £96.8m in the year to February 27.